Foreign direct investment in India is set to swell in coming years as investors stomach a lack of transparency, poor infrastructure and policy paralysis in their search for growth, professional services firm Ernst & Young (E&Y) said in a report.

Overseas investment in Asia's third-largest economy rose for the first time in three years in 2011, the report noted, as global investors put their faith in rising salaries, an expanding middle-class and a large and cheap labor force.

"The fundamentals that make India attractive to investors remain intact," Farokh T Balsara, head of markets at Ernst & Young India, wrote in the report released on Sunday.

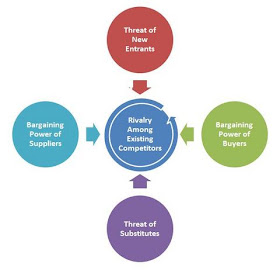

"However, our respondents continue to cite inadequate infrastructure and a lack of governance and transparency as major obstacles to investment."

Foreign direct investment (FDI) in India rose 13% to USD 50.81 billion in the first 11 months of 2011 from a year earlier, while the total number of projects rose 25% to 864, the report said, citing data from the Financial Times' FDI Intelligence service.

Business confidence in India has declined over the past year, as economic growth slowed from an annual rate of 8.5% in 2010/11 to about 7%, and corruption and policy paralysis discouraged investment in big projects.

Just over half of chief executives in India are still "very confident" of revenue growth in the next 12 months, down from 88% a year ago, according to a recent survey by PricewaterhouseCoopers.

The majority of companies surveyed by E&Y were confident in the long-term prospects for investment in India, given sluggish growth in the United States and debt problems in Europe.

Almost 70% of 382 international companies surveyed said they plan to increase or maintain their operations in India, said the report, which was prepared for the World Economic Forum gathering in Davos, Switzerland.

Just 19% said they had no plans to enter the country or were preparing to withdraw.

Robust domestic demand, cost competitiveness and a cheap, ever-growing labour force were cited India's key benefits.

"Although the ongoing global uncertainty...(has) prompted some discomfort among global investors to make long-term commitments, India's inherent advantages and its proven resilience to counter macroeconomic challenges far outweigh these concerns," Balsara said.

Automakers led the way in investing in India last year, boosting spending by 46%, E&Y said.

Technology and life sciences companies were other big spenders, while spending by foreign companies on infrastructure and retail projects declined.

Ford Motor Co, which said this month it would spend USD 142 million on its Indian operations, and the Renault-Nissan alliance are among companies that are stepping up investment in India.

Other companies, particularly retailers, are not so sure.

Sweden's IKEA, the world's biggest furniture retailer, said this week that would be difficult to set up shop in India because of complex government sourcing rules announced this month.

Plans by companies such as Wal-Mart were set back in December when the government, under pressure from political allies, abandoned a long-mooted policy to open up the supermarket sector to direct investment by foreign companies