It's not just accountancy specialists who deal with spreadsheets, and figures, and the financial side of business. It's highly likely that, as a line manager or department head, you're going to have to analyze a spreadsheet at some point, or have some form of financial recording to do as part of your job description.

However, if you feel baffled by balance sheets, or confused by cash flow statements, then read on. This article will take you through the basics of finance for non-financial managers, to help you become familiar with the terminology – and what it all means.

Financial management is a crucial aspect of any thriving business. Profit maximization, or stockholder wealth maximization, are two real concerns for any organization – and they depend on solid financial decisions. To make good decisions, management needs good information. And that information comes from the accounting system.

From the accounting system come the financial statements. These statements contain important information about the organization's operating results. This information is important for effective management, and financial control. As a manager, or any other person with financial responsibility, you have to be able to interpret this information yourself.

Financial statements contain important information about your company's operating results and financial position. The relationship between certain items of financial data can be used to identify areas where your firm excels and, more importantly, where there are opportunities for improvement. Using, understanding, and interpreting these statements will help you make much better business decisions.

The Basic Financial Statements

Businesses record their performance in standard formats called financial statements. The most common of these are:

- Balance Sheet (also known as a Statement of Financial Position, or a Statement of Financial Condition).

- Income Statement (Statement of Profit and Loss, Statement of Earnings, Statement of Operations).

- Cash Flow Statement.

While these statements look at different aspects of the company, they are interrelated and dependent on each other, as information from one is needed to prepare the others. The key to understanding accounts is to have a good grasp of what the basic statements are there to do: how they are prepared, what they tell you, and what they don't.

Tip 1:

This article refers to many accounting and finance terms, many of which can be found in our Words Used In… Financial Accounting article.

Tip 2:

If you're not at all familiar with accounts, this article is going to seem quite complicated. However, this is hugely important information once you get beyond a certain level in your career, so it's worth persisting with it!

This article refers to many accounting and finance terms, many of which can be found in our Words Used In… Financial Accounting article.

Tip 2:

If you're not at all familiar with accounts, this article is going to seem quite complicated. However, this is hugely important information once you get beyond a certain level in your career, so it's worth persisting with it!

Read this article three times: firstly, skim it to get an overview of what the income statement, balance sheet, and cash flow statements are. Then give it a thorough re-read so that you understand what's happening in detail. Finally, work through again to cement your understanding. And if you have any questions, just ask in the forums!

The Bookkeeping Process

Every time your organization conducts a business transaction, the status of the accounts changes. In a retail company, for example, when a sale is made, the cash account increases, and the inventory decreases. The bookkeeping process keeps track of these changes in various ledgers and journals. The financial statements are then prepared using this information.

Accounting is based on the fundamental accounting equation:

Total Assets = Total Liabilities + Equity

This essentially means that the difference between what the business owns and what it owes represents the equity the company's owners have.

To keep this equation in balance means that, with each transaction, at least two accounts – and the balances in those accounts – will change. Accounting is the process of keeping track of those changes, and recording and then reporting them.

Transaction Example: On August 2, 2008, Tom's Plumbing purchased a computer for $1500 with $500 cash deposit, and the remainder on a store credit program. There are three accounts affected:

- The asset account 'Equipment.'

- The asset account 'Cash.'

- The liability account 'Accounts Payable.'

These specific accounts can be found in what is called the Chart of Accounts. The titles Equipment, Cash, and Accounts Payable are not random; these are specific accounts that were identified as relevant to the company before it began operating as a business.

The Chart of Accounts is a list of all the accounts used by a company to record financial transactions. The accounts are grouped according to type, and then numbered using the following conventions:

Asset 101-199.

Liability 200-299.

Equity 300-399.

Revenue 400-499.

Expense 500-599 (some systems use 600s).

Liability 200-299.

Equity 300-399.

Revenue 400-499.

Expense 500-599 (some systems use 600s).

To keep track of transactions efficiently, a General Journal (Original Book of Entry) is used. The journal records what happened, the accounts affected, and the dollar amounts.

Once you've identified the accounts that are involved, you need to apply the rules of what accountants call 'transaction analysis.' This involves the following:

- Asset and Expense accounts are increased by a debit, and decreased by a credit.

- Liabilities, Equity, and Revenue accounts are increased by a credit, and decreased by a debit.

Example:

Having a chronological record of the business' transactions is very useful, should you need to go back and review a particular transaction at a later date. The problem with keeping information in this format, though, is that there is no way to determine what the actual balance in each account is after each transaction. For example, you may need to know how much cash is actually in the cash account, and thus in the bank account, at any given time. To keep track of account balances, accountants use what is called a General Ledger.

The General Ledger consists of ledger accounts, one for each account set up in the Chart of Accounts. Debits and credits to each account are posted to the ledger from the journal, and the balance is kept current. Posting is the process of transferring amounts from the general journal to specific general ledger accounts. Because entries are recorded in the ledger after the journal, the general ledger is often called the Book of Final Entry.

Here's an example:

Note the account balances from the previous month in the Cash and Bank Loan accounts. The 'Balance' column is used to keep a running total of the account balances.

The journalizing and posting process are the first two steps of the entire accounting cycle. From there, the Financial Statements are prepared.

As mentioned earlier, the financial statements are interrelated. To better understand the relationship between these statements, we'll look at Tom's Plumbing statements as they change from the start of an accounting period to the end.

Balance Sheet

A Balance Sheet indicates the financial position of a business at one point in time; it shows what the business owns and owes. The general journal captures day-to-day account balances. At the end of an accounting period, a Balance Sheet is prepared.

The Balance Sheet has three sections:

Assets – the things of value that the company owns.

Liabilities – obligations to pay or provide goods or services at some later date.

Equity – the amount of net assets (assets - liabilities) owing to the owners of the business.

Liabilities – obligations to pay or provide goods or services at some later date.

Equity – the amount of net assets (assets - liabilities) owing to the owners of the business.

The Balance Sheet is named as such because the total of the assets must equal the total of the liabilities and equity. What a company owns equals what it owes to its creditors and owners.

Tom's Plumbing | ||||

Balance Sheet | ||||

As at July 31, 2008 | ||||

| Assets | Liabilities | |||

| Cash | 5,500 | Bank Loan | 5,000 | |

| Inventory | 8,000 | Accounts Payable | 1,000 | |

| Accounts Receivable | 3,500 | Total Liabilities | 6,000 | |

| Equipment | 2,500 | |||

| Equity | ||||

| Paid in Capital | 10,000 | |||

| Retained Earnings | 3,500 | |||

| Total Equity | 13,500 | |||

| Total Assets | 19,500 | Total Liabilities & Equity | 19,500 | |

As at July 31, Tom's Plumbing has $19,500 in Assets, $6,000 in Liabilities, and $13,500 in Equity.

The accounting staff at Tom's Plumbing dutifully record all the transactions that occur during the month of August, and they prepare an Income Statement to summarize the information.

Income Statement

At certain points during the year, each business wants to know how well it is doing. Is it earning a profit? Is it losing money? Just how well is it doing compared to other firms? Is it likely to be able to earn a profit in the future? To answer these questions, it uses an Income Statement.

The Income Statement communicates the inflow of revenue, and the outflow of expenses, over a given period of time. Revenue is the inflow of assets (i.e. cash or accounts receivable) to a company in return for services performed, or goods sold. Expenses are the outflow or consumption of assets (i.e. cash, inventory, supplies), or obligations incurred (i.e. accounts payable, taxes payable) while generating revenue. The difference between these two is the Net Income.

An Income Statement therefore shows the operating profit (or loss) of a business.

| Tom's Plumbing | ||

| Income Statement | ||

| For the month ended August 31, 2008 | ||

| Revenue | ||

| Sales Revenue | 7,000 | |

| Repair Revenue | 3,000 | |

| Total Revenue | 10,000 | |

| Expenses | ||

| Rent | 550 | |

| Wages | 2,300 | |

| Inventory | 4,000 | |

| Depreciation | 200 | |

| Total Expenses | 7,050 | |

| Net Income | 2,950 | |

The Net Income amount is the amount by which a company's equity increases or decreases for the period. An equity account is used to record the change that results from business operations. In a proprietorship, this is typically called Retained Earnings. In corporations, it is called Owner's Equity.

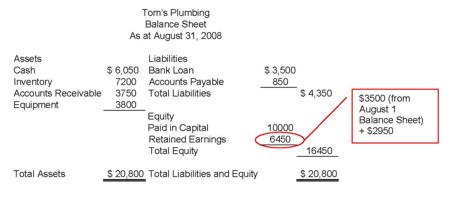

When Tom's Plumbing goes to prepare its Balance Sheet as at August 31, 2008, it must include the $2950 of Net Income as an increase to the Retained Earnings Account. The Balance Sheet for the end of the month is also prepared:

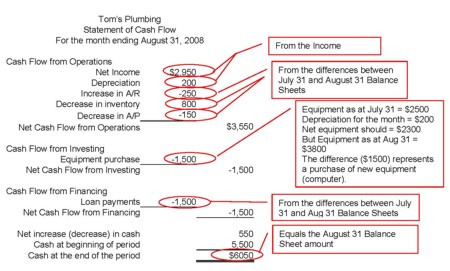

Many people are inclined to think that, because Tom's Plumbing had a net income of $2950, the cash account increased by $2950. As you can see, this is not the case: cash increased by only $550. The reason for this is because income can be accounted for in ways other than cash; and activities other than operations, like financing and investment, can affect cash. To get an accurate picture of the actual cash generated by a business in a period you must prepare a Cash Flow Statement (Statement of Changes in Financial Position).

Cash Flow Statement

The Cash Flow Statement records inflows and outflows of cash during a period of time, and is divided into cash flow from operations, financing, and investing activities. To prepare a statement of cash flow you must convert net income from accrual-based accounting to cash. You therefore have to add and subtract changes in non-cash accounts that have accrued during the period.

For instance, you need to add back depreciation amounts, because although depreciation expense decreases net income, it has no bearing on actual cash. Likewise, you have to deduct any decreases in accounts payable because that is a use of cash that was not accounted for on the Income Statement. The following table outlines the major sources and uses of cash:

| Sources of Cash | Uses of Cash |

| Operations | Cash Dividends |

| New loans | Repayment of loans |

| New stock issues or owner investment | Repurchase of stock |

| Sale of property, plant, or equipment | Purchase of property, plant, or equipment |

| Sale of other non-current asset | Purchase of other non-current asset |

By analyzing the differences between the balance sheets for the beginning of the period and the end of the period, and accounting for the net income for the period, you can prepare a Cash Flow Statement:

The $550 dollar increase in cash has been explained by converting accrued amounts into actual cash value.

Understanding the interrelatedness of the financial statements is very important when reading and interpreting them. Understanding where the numbers come from, and what they actually mean, is extremely important when evaluating your own performance, or comparing your performance to others.

Financial Statement Interpretation

Armed with some knowledge of accounts, it's important to understand what the statements actually tell you.

What an Income Statement says:

- The Income Statement reports the main and any secondary sources of income. For example, Fees Earned would be the primary revenue in a dental office. If they had bonds, a secondary source of revenue would be Interest Earned from Bond Investment.

- The terms used to describe the revenue will provide a clue about the nature of the organization. For example, Fees Earned implies a service company; Commissions Earned implies a brokerage; while Sales Revenue implies a retail or wholesale firm.

- The items listed as expenses are expired, meaning they have no useful value left.

- The result of matching the revenues and expenses yields the Net Income or Net Earnings if the statement is called the Earnings Statement. The term 'net' implies that the revenues and expenses have been matched, and therefore there is not an over or under statement of the income (loss).

What an Income Statement does not say:

- An Income Statement does not predict the future net income for any accounting period. Since the future is full of uncertainty, a reader of a historical Income Statement can't rely on the reported results of any single period for an indication of future results.

- An Income Statement, no matter how well prepared, does not provide an exact measurement of net income for the accounting period. No matter how hard you try, it is impossible to get an exact match. Consider, for example, an advertising expense. If management spent $1,000 in December on advertising, and achieved $5,000 sales revenue for December, that does not mean that the advertising brought in exactly $5,000 revenue. There may also be revenue generated in January that can be attributed to the December advertising. When it is difficult to measure, the expense is accounted for in the period it was incurred.

- An Income Statement does not report True Profit, which is the difference between total funds invested over the life of the company and funds realized from the sale of the company. To calculate this, you would have to calculate the difference between assets invested during the lifetime of the business, and the amount finally received from remaining assets after winding up the business. You would also have to deduct any personal withdrawals because these were actually paid out of the 'profits.'

- Net Income does not mean cash! Always keep in mind that net income is the excess revenue over related expenses for a specific accounting period. Cash has very little to do with determining net income. True, revenue refers to an inflow of cash and expense to an outflow, but often the inflow of cash is used for further investment. Additionally, revenues and expenses are recorded at the time of occurrence, not when cash changes hands. What about the case of depreciation expense which does not represent an outflow of cash at all?

What a Balance Sheet says:

- A Balance Sheet gives readers a detailed summary of the assets and claims against those assets, as at a particular date.

- A Balance Sheet provides the reader with information about the financial position of the firm with regard to its ability to pay current debts. By comparing the current assets to the current liabilities, the reader can assess whether the company is in a position to meet to meet its short-term financial obligations.

- A Balance Sheet gives the reader a view of the firm's financial position to carry on its business operations. The fixed-asset section indicates how many resources the company has working for it to assist in revenue generation.

- Finally, a Balance Sheet reveals the strength of the owner's claim against the assets. Remember, however, that this claim is residual, or the remaining claim after the creditors'.

What a Balance Sheet does not say:

- A Balance Sheet does not report the details of how the profits were made. That information comes from the Income Statement.

- A Balance Sheet does not show the claims of the creditors and the owner(s) against a specific asset. The claims are against the assets in general.

- The word 'Capital' under owner's equity must not be interpreted as cash. The investment can come in many forms – cash being just one of them. The owner's original cash investment may have gone primarily to purchase fixed assets in order to assist revenue generation. Capital means investment not cash.

- A Balance Sheet does not report the market value, current value, or worth of a business. Many readers believe the total assets represent a bundle of future cash reserves. This is not true because fixed assets are reported at historical cost, and their purpose is to assist revenue generation. They are not intended for sale to enhance cash flow.

Key Points:

Accounting is a language unto itself. To become perfectly fluent takes a great deal of training and experience. Thankfully, non-financial managers, and other employees with financial responsibility, can learn to be conversant with the key terminology. The bookkeeping process is how day-to-day transactions are recorded. Balances in the various accounts are tracked and summarized in the financial statements. The financial statements bring the cycle full circle as they reflect the changes that happened during the accounting period. By understanding this cycle, you have a much better appreciation for the numbers on the financial statements, and you can use them to make sound managerial decisions.